Our systems already benefit the rich. They can afford a few more taxes

#Wealth tax #Billionaires #Income inequality #Los Angeles Times #Fiscal policy #Social services #Financial reform

📌 Key Takeaways

- Public advocates are calling for a 5% one-time tax on billionaires to address economic inequality.

- Arguments suggest that even after significant taxation, the ultra-wealthy would maintain immense personal fortunes.

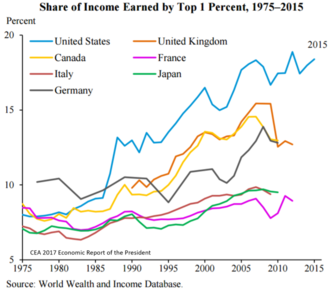

- The current economic system is criticized for providing disproportionate benefits to high-net-worth individuals.

- Revenue from increased taxes could be redirected to bolster failing public infrastructure and social programs.

📖 Full Retelling

🏷️ Themes

Economic Policy, Social Justice, Taxation

📚 Related People & Topics

Fiscal policy

Use of government revenue collection and expenditure to influence a country's economy

In economics and political science, fiscal policy is the use of government revenue collection (taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables developed in reaction to the Great Depression of the 193...

Income distribution

Distribution of a country's total GDP amongst its population

In economics, income distribution covers how a country's total GDP is distributed amongst its population. Economic theory and economic policy have long seen income and its distribution as a central concern. Unequal distribution of income causes economic inequality which is a concern in almost all co...

Wealth tax

Tax on an entity's holdings of assets

A wealth tax (also called a capital tax or equity tax) is a tax on an entity's holdings of assets or an entity's net worth. This includes the total value of personal assets, including cash, bank deposits, real estate, assets in insurance and pension plans, ownership of unincorporated businesses, fin...

Los Angeles Times

American daily newspaper

The Los Angeles Times is an American daily newspaper that began publishing in Los Angeles, California, in 1881. Based in the Greater Los Angeles city of El Segundo since 2018, it is the sixth-largest newspaper in the U.S. and the largest in the Western United States with a print circulation of 79,10...

Billionaire

Person who has at least one billion units of a currency

A billionaire is a person whose net worth is at least one billion units of a given currency, typically USD. It is a sub-category of the concept of the ultra high-net-worth individual. The American business magazine Forbes produces a global list of known U.S. dollar billionaires every year and update...

🔗 Entity Intersection Graph

Connections for Fiscal policy:

- 👤 Capitol Hill (1 shared articles)

- 🌐 United States Secretary of the Treasury (1 shared articles)

- 👤 Scott Bessent (1 shared articles)

- 👤 One Big Beautiful Bill Act (1 shared articles)

- 🌐 Income distribution (1 shared articles)

- 👤 Internal Revenue Service (1 shared articles)

- 🌐 CBO (1 shared articles)

- 👤 Donald Trump (1 shared articles)

- 🌐 Deficit spending (1 shared articles)

- 🌐 Government debt (1 shared articles)

📄 Original Source Content

'A one-time 5% tax on $1 billion would leave the taxpayer a mere $950 million. Hardly abject poverty,' writes an L.A. Times reader.