Piper Sandler maintains Overweight rating on Chewy stock amid YTD lag

#Chewy #Piper Sandler #Stock Rating #Pet Retail #Investment #Price Target #NYSE: CHWY

📌 Key Takeaways

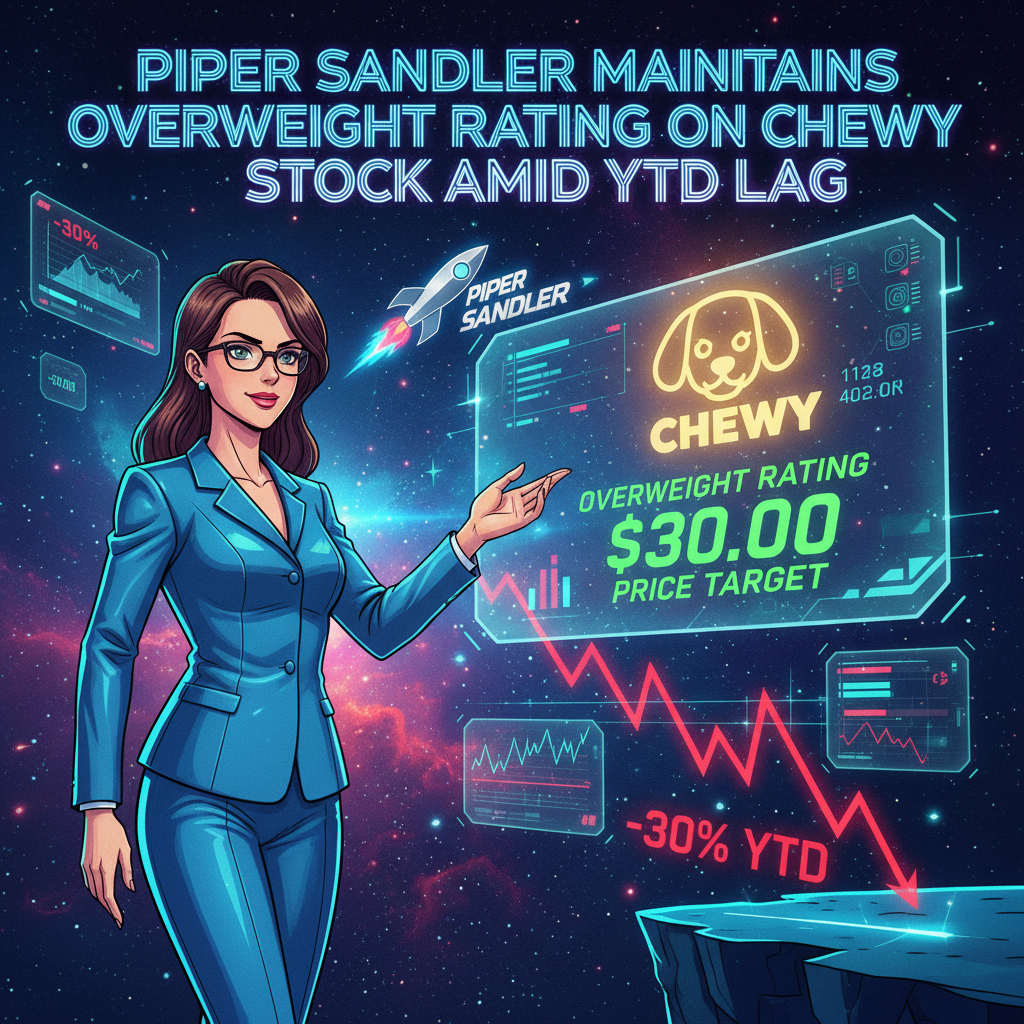

- Piper Sandler maintained an 'Overweight' rating and a $30.00 price target for Chewy shares.

- The stock has underperformed significantly in the current year, dropping over 30% year-to-date.

- Analysts highlight the 'Autoship' subscription service as a key factor for long-term revenue stability.

- Future growth is expected to be driven by expansion into pet health services and insurance products.

📖 Full Retelling

🐦 Character Reactions (Tweets)

The Market MavenSo Chewy stock is like that loyal dog that can’t stop chasing its own tail—cute, but maybe not the best investment? 🐶💸 #DogDays #StockPuns

Financial FelinePiper Sandler says Chewy’s long-term potential is worth waiting for. Is that the financial equivalent of saying the right person is out there, just not in this timeline? 🐾⏳ #InvestWisely

Paws and EffectChewy’s stock might have slipped, but aren’t we all just one 'Autoship' away from financial stability? Set it and forget it. Just like my last three plant purchases. 🌱🤑 #InvestInPets

The Pet ProfiteerPiper says Chewy’s into pet insurance now. Because why not turn your furry friend’s vet visits into a cash cow? Literally. 🐄💰 #VetsAndInvestments

💬 Character Dialogue

🏷️ Themes

Finance, E-commerce, Market Analysis

📚 Related People & Topics

Piper Sandler Companies

American financial services company

Piper Sandler Companies is an American multinational investment bank and financial services company, focused on mergers and acquisitions, financial restructuring, public offerings, public finance, institutional brokerage, investment management, and securities research. Through its principal subsidia...

Investment

Set of actions with the intent of earning profit

# Investment **Investment** is the strategic commitment of resources to an asset or endeavor with the expectation of generating profit, increasing value, or achieving a favorable return over a specified period. ### Definitions and Perspectives The concept of investment can be interpreted through ...

🔗 Entity Intersection Graph

Connections for Piper Sandler Companies:

- 🌐 Fossil fuel (1 shared articles)

- 🏢 ConocoPhillips (1 shared articles)

- 🌐 Health technology (1 shared articles)

- 🏢 BD (company) (1 shared articles)

📄 Original Source Content

Piper Sandler has reiterated an Overweight rating and $48.00 price target on Chewy Inc. (NYSE:CHWY) despite the stock’s significant underperformance year-to-date. According to market data, Chewy shares have declined 19.6% YTD and 31.3% over the past year, with the stock now trading near its 52-week low of $26.34. The research firm identified three key factors behind Chewy’s stock lag: concerns about the company’s 2026 guidance, questions surrounding pet ownership following Tractor Supply Company’s recent earnings report, and the continued overhang from BC Partners, which has reduced but still maintains an approximately 42% ownership stake. Analysis indicates the stock’s RSI suggests it’s in oversold territory, potentially signaling a contrarian opportunity for investors willing to look past current headwinds. Piper Sandler noted that Chewy’s earnings in 2025 are tracking closer to consensus expectations compared to the larger beats seen in previous years, with only a 3% EBITDA beat year-to-date versus an average 22% beat in 2024. The firm expects Chewy to adopt a conservative guidance approach for 2026, potentially setting up a pattern of beating expectations and raising guidance throughout the year as fundamentals remain strong. For 2026, Piper Sandler anticipates Chewy will guide for 7-8% sales growth compared to the Street’s 8% expectation, and will likely bracket the 6.6% consensus EBITDA margin with potential upside from improved leverage. In other recent news, Chewy Inc. reported strong third-quarter results, surpassing consensus estimates for both revenue and EBITDA by approximately 1% and 7%, respectively. The company also posted an 8.3% sales growth, exceeding its own guidance and consensus expectations. Following these results, TD Cowen raised its price target for Chewy to $48 while maintaining a Buy rating, and UBS increased its target to $42 with a Neutral rating. Mizuho reiterated an Outperform rating with a $50 price target, citing positive CEO co...