The "K-shaped" economy will affect your 2026 tax refund

#IRS #Tax refunds #K-shaped economy #Big Beautiful Bill Act #Fiscal policy #Income inequality #Tax returns

📌 Key Takeaways

- The 'Big, Beautiful Bill' Act will result in larger tax refunds for many Americans starting in 2026.

- A 'K-shaped' distribution means higher-income households will benefit significantly more than lower-income ones.

- The policy changes aim to address inflation and stimulate the economy through tax return adjustments.

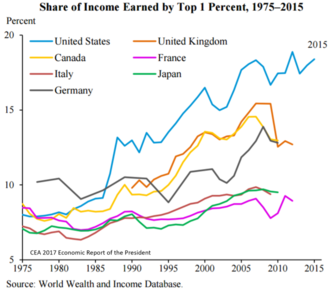

- The disparity in refund sizes highlights growing wealth inequality in the current economic recovery.

📖 Full Retelling

🏷️ Themes

Economy, Taxation, Wealth Inequality

📚 Related People & Topics

One Big Beautiful Bill Act

2025 legislation in the United States

The One Big Beautiful Bill Act (OBBBA) or the Big Beautiful Bill (P.L. 119-21), is a U.S. federal statute passed by the 119th United States Congress containing tax and spending policies that form the core of President Donald Trump's second-term agenda. The bill was signed into law by Trump on July 4...

Fiscal policy

Use of government revenue collection and expenditure to influence a country's economy

In economics and political science, fiscal policy is the use of government revenue collection (taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables developed in reaction to the Great Depression of the 193...

Income distribution

Distribution of a country's total GDP amongst its population

In economics, income distribution covers how a country's total GDP is distributed amongst its population. Economic theory and economic policy have long seen income and its distribution as a central concern. Unequal distribution of income causes economic inequality which is a concern in almost all co...

Internal Revenue Service

Revenue service of the US federal government

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury an...

🔗 Entity Intersection Graph

Connections for One Big Beautiful Bill Act:

- 🌐 Trump account (1 shared articles)

📄 Original Source Content

Tax refunds will be bigger this year because of the big, beautiful bill" act, with higher-income households set to reap the biggest checks.