UBS downgrades Banco de Chile stock rating to Neutral on limited upside

#UBS #Banco de Chile #Stock Rating #Price Target #Earnings Report #Chilean Banking #Macroeconomic Conditions #Tax Rate Reduction

📌 Key Takeaways

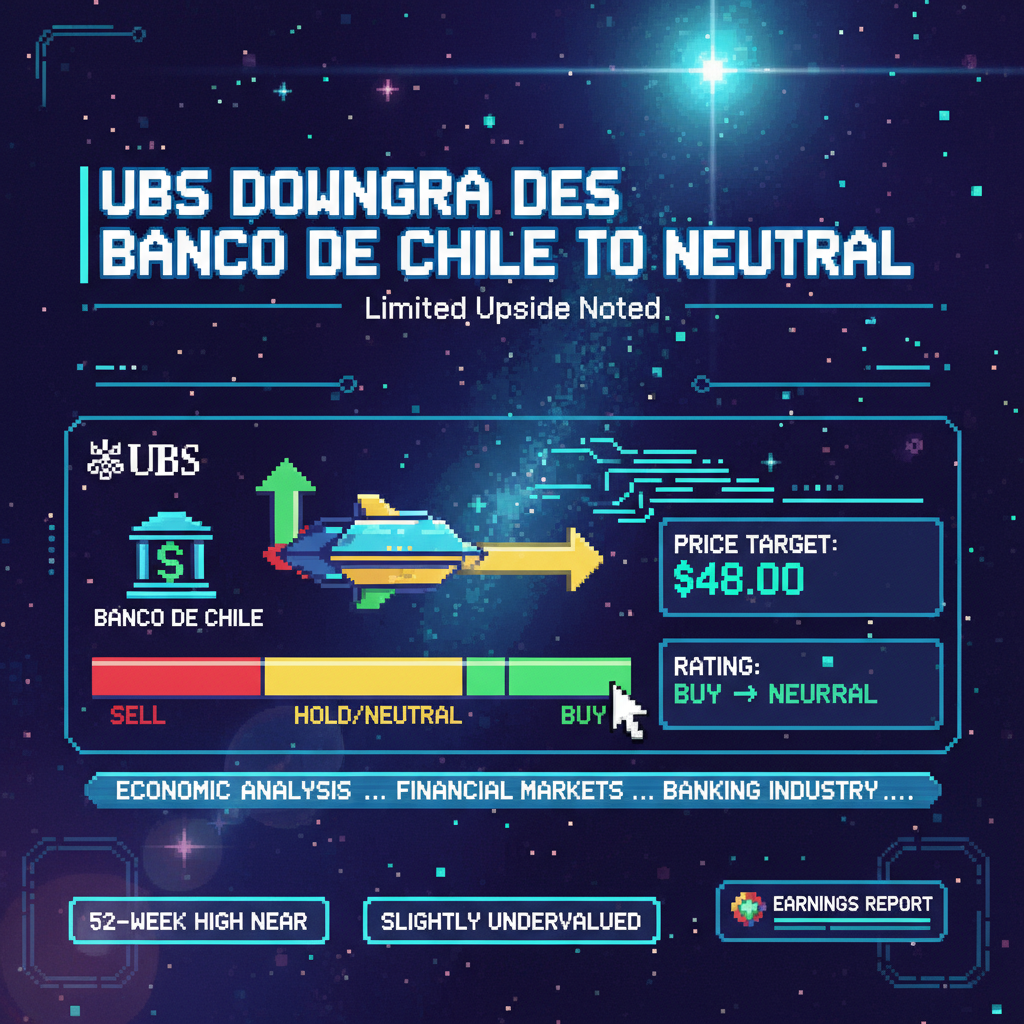

- UBS downgraded Banco de Chile's stock rating from 'Buy' to 'Neutral' while raising its price target to $48.00.

- The stock is near its 52-week high, with data indicating it is slightly undervalued.

- UBS reassessed the bank's fundamentals and concluded limited upside potential.

- Ongoing discussions about a potential tax rate reduction could improve the bank's return on equity.

- Banco de Chile reported stable revenue and a net income of CLP 1.2 trillion for 2025.

📖 Full Retelling

🏷️ Themes

Economic Analysis, Financial Markets, Banking Industry, Investment Strategy

📚 Related People & Topics

Banco de Chile

Chilean bank

Banco de Chile (English: Bank of Chile) is a Chilean bank and financial services company with headquarters in the city of Santiago de Chile. It's a commercial bank that provides a range of financial services to clients. As of December 31, 2012, Banco de Chile has a national network of 434 branches, ...

UBS

Multinational investment bank headquartered in Switzerland

UBS Group AG (stylized simply as UBS) is a Swiss multinational investment bank and financial services firm founded and based in Switzerland, with headquarters in both Zurich and Basel. It holds a strong foothold in all major financial centres as the largest Swiss banking institution and the world's ...

📄 Original Source Content

UBS downgraded Banco de Chile (NYSE:BCH) from Buy to Neutral while raising its price target to $48.00 from $41.00. The stock currently trades at $44.66, near its 52-week high of $46.77, with data showing the bank is slightly undervalued based on its Fair Value assessment. The rating change reflects UBS’s reassessment of both top-down and bottom-up fundamentals for the Chilean bank. UBS indicated that despite the higher price target, which was largely attributed to foreign exchange impacts, the stock now presents limited upside potential, resulting in what the firm describes as a balanced risk-reward profile. The investment bank acknowledged that Banco de Chile remains a strong and reputable franchise, but believes the current valuation appropriately reflects both the bank’s operational prospects and the supportive Chilean macroeconomic conditions anticipated for 2026. UBS also noted that ongoing discussions regarding a potential reduction in Chile’s statutory tax rate from 27% to 23% could improve the bank’s return on average equity by approximately 80 basis points. However, this is not reflected in their earnings model and would be insufficient to trigger further multiple re-rating. In other recent news, Banco de Chile announced its fourth-quarter 2025 earnings, emphasizing stable revenue and a robust market position. The bank reported a net income of CLP 1.2 trillion for the year, underscoring its leadership in the Chilean banking industry. Despite a slight dip in premarket trading, Banco de Chile maintained its financial strength and stability. Analysts from various firms have noted the bank’s consistent performance. These developments reflect the bank’s ability to sustain its market position amidst a competitive environment. Investors are keeping a close eye on Banco de Chile’s performance as it continues to navigate the financial landscape, with the recent earnings report providing a clear picture of its current financial health.